In an effort to diversify their portfolios and possibly generate large returns, investors have become more interested in startup investments in recent years. This type of investment entails providing capital to start-up businesses with creative concepts and promising future growth. But it’s also critical to recognize that startups face a high risk of failing. Many important factors should be assessed when thinking about starting investments:.

1.

Key Takeaways

- Start up investments can be a high-risk, high-reward opportunity for investors looking to support innovative new businesses.

- Tech and Artificial Intelligence start ups are attracting significant investment due to their potential to disrupt traditional industries and create new efficiencies.

- Green and sustainable energy start ups are gaining traction as the world shifts towards renewable energy sources and sustainable practices.

- Health and wellness start ups are addressing the growing demand for innovative solutions in the healthcare and wellness industries.

- E-commerce and online marketplaces continue to be a hot area for start up investment, driven by the shift towards digital shopping and convenience.

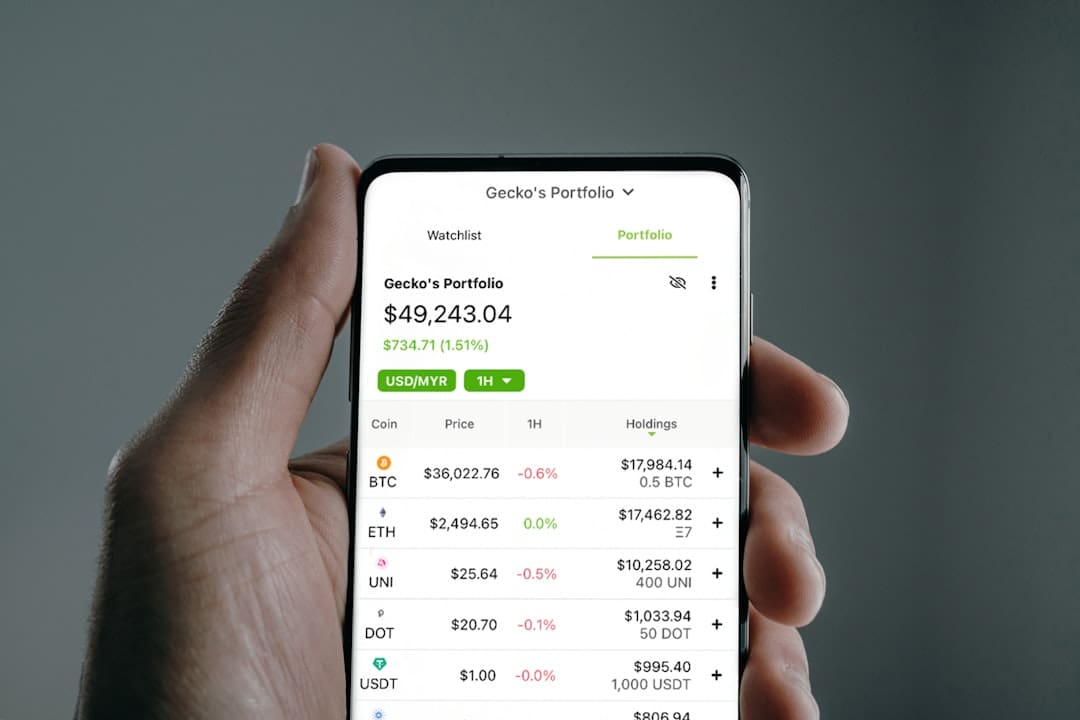

- Financial technology (Fintech) start ups are revolutionizing the way we handle money and conduct financial transactions, making them an attractive investment opportunity.

- When investing in start ups, it’s important to conduct thorough research, diversify your portfolio, and seek professional advice to mitigate risks and maximize potential returns.

Extensive research is necessary. Potential investors should look into the start-up’s founders, market potential, and competitors. 2. Business model: It’s critical to comprehend the company’s scalability and revenue generating strategy.

Three. Management team: It is crucial to evaluate the skills and background of the leadership to ascertain their capacity to carry out the business plan. In 4. Market analysis: Determining the size, growth potential, and industry trends of the target market aids in assessing the start-up’s chances. 5. Financial projections: To fully grasp the potential rewards and risks of an investment, one must review realistic financial forecasts & financing requirements. 6.

Legal and regulatory considerations: Risk assessment requires analyzing potential legal & regulatory obstacles the start-up may encounter. 7. Exit strategy: Knowing about possible ways out, like buyouts or IPOs, aids investors in making long-term financial plans. Investors can make better decisions when making start-up investments if they carefully consider these factors. It’s crucial to keep in mind, though, that start-up investments carry some risk even after doing extensive due diligence, so they should be handled carefully as part of a diversified investment strategy. Upending Conventional Sectors.

| Company | Industry | Investment Amount |

|---|---|---|

| Robinhood | Finance | 2.4 billion |

| Rivian | Automotive | 2.5 billion |

| Chime | Finance | 750 million |

| Instacart | Retail | 265 million |

Tech companies have a ton of chances to disrupt established markets & develop ground-breaking solutions because of how quickly technology is developing. There is a ton of room for expansion in the tech and AI sectors, from automation and robotics to machine learning & data analytics. Start-ups Powered by AI are transforming industries. Start-ups that use technology to solve problems in the real world and increase productivity should be taken into consideration by investors hoping to profit from this trend.

A wave of AI-driven start-ups has emerged in recent years, transforming sectors including healthcare, finance, and transportation. These businesses are employing AI to make previously unthinkable predictions, automate procedures, and analyze massive datasets. Analyzing the State of Regulation & Technology. Considering the technology these start-ups are using and their likelihood of being widely adopted are crucial considerations for investors. The ethical and regulatory context of AI technology should also be carefully considered, as these aspects can have a big impact on a start-up’s long-term success.

Green and sustainable energy start-ups have attracted a lot of investor attention as concerns about climate change and environmental sustainability grow. These businesses are creating cutting-edge approaches to boost energy efficiency, lower carbon emissions, and use renewable energy sources. There are a plethora of options for start-ups to both positively impact the environment and provide investors with profitable returns, from solar and wind power to energy storage & smart grid technologies.

It takes in-depth knowledge of the energy sector, laws, & technology developments to invest in green and sustainable energy start-ups. When deciding which start-up to invest in, it’s critical to consider the technology, market potential, and competitive environment. Investors should also take long-term energy sector trends like the move toward renewable energy and the rise in demand for clean technologies into account.

Investors can make a significant contribution to promoting positive change while simultaneously benefiting financially by spotting promising green energy start-ups with strong leadership and creative solutions. Due to rising consumer awareness of the value of both physical and mental well-being, the health & wellness sector has grown significantly in recent years. Startups in this field are creating a broad range of goods and services, such as fitness & personalized nutrition technologies, telemedicine solutions, & digital health platforms. When making an investment decision, it’s critical for investors to thoroughly consider the market potential, regulatory environment, & competitive dynamics of health and wellness start-ups. Scalability and broad market acceptance of the products or services offered by health and wellness start-ups are important factors to take into account before making an investment. Start-ups have a lot of opportunities to challenge established healthcare models and increase access to high-quality care because of technological advancements and shifting consumer demand.

It’s also critical to take into account the regulatory landscape & any potential entrance obstacles in the health & wellness sector. Investors can both generate attractive returns and improve public health by identifying promising start-ups with innovative solutions and strong market traction. The emergence of e-commerce & virtual marketplaces has revolutionized consumer purchasing habits & business practices.

In this industry, startups are using technology to connect buyers and sellers, streamline supply chain processes, & create seamless shopping experiences. Investment opportunities in the expanding field of digital commerce are plentiful, ranging from specialized e-commerce platforms to international online marketplaces. The size of the market, the competitive landscape, and customer acquisition tactics are all important considerations for e-commerce and online marketplace start-ups. Also, investors ought to evaluate a start-up’s capacity for long-term growth in a sector that is changing quickly, as well as the scalability of its business plan. There are many opportunities for start-ups to challenge established retail models and take market share due to the growing acceptance of digital payments and shifting consumer preferences.

Investors may set themselves up for success in this fast-paced sector by spotting promising e-commerce and online marketplace start-ups with strong leadership and creative solutions. Important Things to Take Into Account When Assessing Fintech Startups. A thorough assessment of the market potential, competitive dynamics, and regulatory environment surrounding Fintech start-ups is imperative for investors prior to deciding which investments to make. The potential for upending established financial services & the capacity to overtake them in market share are two important factors. Locating Growth Prospects.

As a result of shifting consumer habits and technological developments, start-ups have a lot of potential to add value by providing more effective and easily accessible financial products. A start-up’s ability to navigate complex regulatory environments and scale its business model are also critical factors to take into account. Developing Finance’s Future. Investors can generate attractive returns & significantly influence the direction of finance in the future by spotting promising Fintech start-ups with creative solutions & strong leadership. In conclusion, for investors looking for chances for high growth & innovation, investing in start-ups can be a lucrative endeavor.

Before making any decisions, it’s crucial to thoroughly weigh the benefits & risks of start-up investments. Investors can improve their chances of success by thoroughly investigating the market, technology, regulatory environment, and competitive dynamics of start-ups in a variety of industries, including tech, green energy, health and wellness, e-commerce & online marketplaces, and Fintech. Assessing the likelihood of scalability, market traction, regulatory ramifications, and ethical issues is critical when thinking about start-up investments. Also, start-ups with capable leadership teams, creative solutions, and a distinct route to long-term growth should be sought after by investors.

Investors may set themselves up for success in the fast-paced world of start-up investments by spreading their investment portfolios across several industries and closely assessing each opportunity. To sum up, investing in start-ups necessitates a blend of careful investigation, strategic deliberation, & a readiness to assume measured risks. Investors may make better choices about providing funds for start-up investments by keeping up to date on market trends, legislative changes, & technology breakthroughs.

Investors can play a critical role in promoting innovation and earning financial rewards in the dynamic realm of start-up investments by carefully weighing these factors & adopting a long-term perspective on investment opportunities.

If you’re looking for start-up companies to invest in, you may want to consider exploring Slay Ventures’ list of female founders who are empowering the industry with a new approach to venture capital funding. This article on empowering female founders sheds light on the innovative and diverse perspectives that these entrepreneurs bring to the table, making them a promising investment opportunity for the future.

FAQs

What are start-up companies?

Start-up companies are newly established businesses that are in the early stages of development. These companies are often founded by entrepreneurs who are looking to bring a new product or service to the market.

Why invest in start-up companies?

Investing in start-up companies can offer the potential for high returns on investment. Additionally, investing in start-ups can provide the opportunity to support innovative ideas and contribute to the growth of new businesses.

What are some factors to consider when investing in start-up companies?

When considering investing in start-up companies, it is important to assess the potential for growth, the strength of the business model, the experience of the management team, and the market demand for the product or service being offered.

What are the risks of investing in start-up companies?

Investing in start-up companies carries inherent risks, including the potential for the company to fail, the lack of liquidity in the investment, and the possibility of dilution of ownership through subsequent funding rounds.

How can I find start-up companies to invest in?

There are various ways to find start-up companies to invest in, including networking with entrepreneurs and industry professionals, attending start-up pitch events and demo days, and utilizing online platforms that connect investors with start-up opportunities.

Leave a Reply

You must belogged in to post a comment.