Startups are recently formed companies that are still in the early phases of development. Usually, these companies are founded by entrepreneurs who want to bring novel goods or services to the market. The innovative concepts, adaptability, & potential for quick growth of these businesses define them. Startups face many obstacles and unknowns in a fast-paced, dynamic environment. All the same, they have the power to upend whole sectors of the economy, open up fresh markets, and bring in good money for investors.

Key Takeaways

- Start-up companies are newly established businesses with high growth potential and innovative ideas.

- Smart investments in start-up companies require thorough research, analysis of market trends, and evaluation of the company’s business model and leadership team.

- Some top start-up companies to watch include those in the technology, healthcare, and sustainability sectors, among others.

- Innovative technologies and services in start-up companies include AI, blockchain, telemedicine, and sustainable energy solutions.

- Success stories of start-up companies often involve disruptive innovation, strong leadership, and effective market positioning.

- Risks and challenges of investing in start-up companies include high failure rates, market volatility, and regulatory hurdles.

- Tips for making smart investments in start-up companies include diversifying the investment portfolio, seeking expert advice, and staying informed about industry trends and developments.

Innovative business models and economic expansion are significantly fueled by startups. They frequently spearhead technological breakthroughs and upend established business paradigms. Many prosperous start-ups have grown into market leaders, revolutionizing a number of facets of social interaction, employment, & daily life. For investors looking to support ground-breaking ideas and possibly make significant financial gains, investing in start-up companies can be an alluring opportunity.

Assessing the Founding Group. The strength of the founding team is a crucial factor. The potential for success of a start-up is frequently indicated by a capable and accomplished team with a proven track record.

Evaluate the good or service. The product or service being offered’s uniqueness and scalability are also important factors. Investors ought to evaluate the start-up’s competitive edge and likelihood of snatching up a sizeable chunk of the market.

| Company Name | Industry | Revenue | Market Value |

|---|---|---|---|

| SpaceX | Aerospace | 2.0 billion | 74 billion |

| Stripe | Finance | 1.6 billion | 95 billion |

| Rivian | Automotive | 1.5 billion | 80 billion |

| Robinhood | Finance | 959 million | 11.7 billion |

In addition, it is imperative to take into account the market opportunity & potential growth. Metrics related to finances and flexibility. A start-up in a big market that is growing quickly is more likely to succeed than one in a crowded or niche market.

A start-up’s financial health & profitability potential can also be determined by financial metrics like revenue growth, customer acquisition cost, and customer lifetime value. Smart investments in start-up companies should take into account the start-up’s ability to execute on its business plan, adjust to changes in the market, and manage resources effectively. Innovative products, disruptive technologies, and the potential for rapid growth have made a number of start-up companies quite popular. One such business is Airbnb, a website that lets people list their homes for temporary rentals. Since its founding, Airbnb has grown at an exponential rate and revolutionized the hospitality sector. Elon Musk founded SpaceX, a noteworthy start-up with the goal of lowering the cost of space travel & facilitating Mars colonization.

Along with upending the aerospace sector, the company has accomplished important space exploration milestones. Also, Uber, a global transportation network company, has revolutionized the way individuals commute and has grown its services internationally. Its creative use of technology & business strategy have made it a dominant force in the ride-sharing market. The commission-free stock trading app Robinhood, which has a sizable user base and democratized investing, is another startup to keep an eye on.

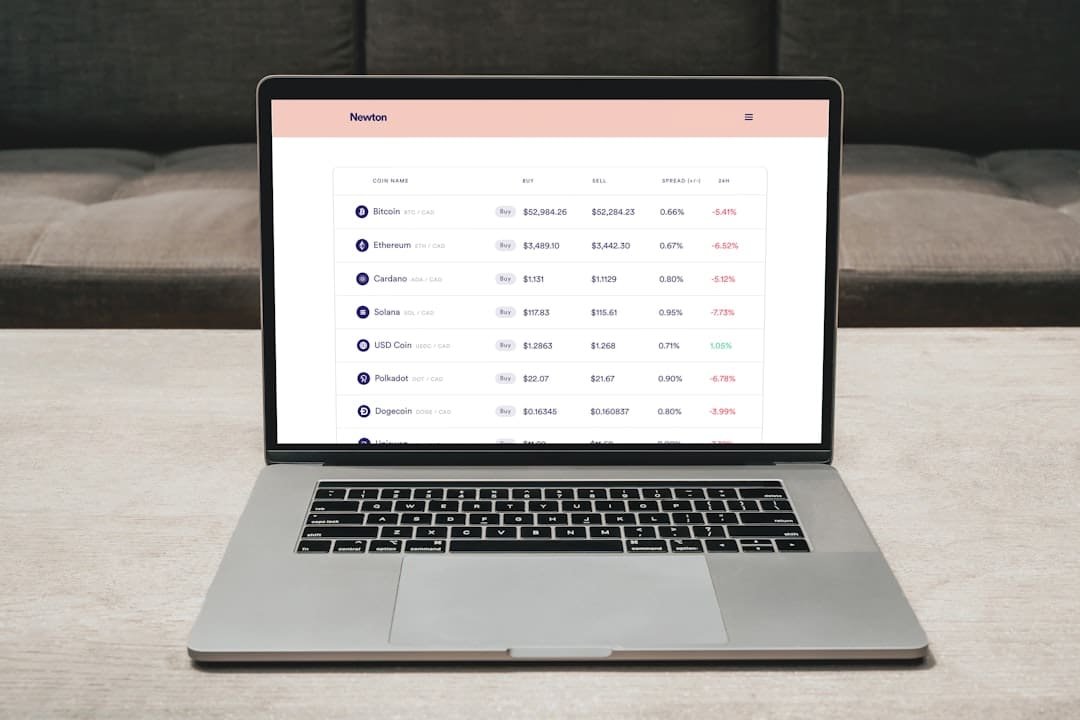

These startups have shown that they have the potential to significantly disrupt the market and have garnered interest from investors. Startups are renowned for their emphasis on innovation & the creation of cutting-edge products and services. Artificial intelligence (AI) and machine learning are being used by a lot of start-ups to develop smart solutions for a range of sectors, such as e-commerce, finance, and healthcare. The use of blockchain technology by startups has also increased, with uses ranging from supply chain management to safe online transactions. To further address urgent environmental challenges, start-ups are spearheading innovations in clean technology, sustainable agriculture, and renewable energy.

Innovative financial services like peer-to-peer lending, digital banking, & mobile payment solutions have been made possible by the growth of fintech start-ups. Insightful investors will find these technologies and services appealing as investment opportunities because they have the potential to revolutionize industries and boost productivity. In the business world, a number of start-up businesses have reached incredible success and gained widespread recognition. Facebook is one example of a success story; it started out as a social networking site for college students & has grown into a multibillion dollar global tech company. Google is a noteworthy example of a successful company that began as a search engine and has since grown to offer a wide range of goods and services. Further evidence of the possibility for start-ups to achieve remarkable success comes from Amazon’s transformation from an online bookshop to a global powerhouse in e-commerce and cloud computing.

These businesses’ explosive growth indicates the revolutionary power that start-ups can wield over entire sectors of the economy. These success stories demonstrate the potential for exponential growth and market dominance within the start-up ecosystem, inspiring both investors & aspiring entrepreneurs. It can be a profitable endeavor to invest in start-up companies, but there are risks and difficulties involved that investors need to be aware of. Failure Risk.

The high start-up failure rate—many new companies fail in their first few years of operation—represents a major risk. If a start-up fails, investors could end up losing everything they invested. The challenges of operations.

Moreover, startups frequently compete in fiercely competitive markets and deal with issues like scarce resources, obstacles from regulations, and shifting customer preferences. Moreover, startups might have trouble growing and turning a profit, which could result in protracted periods of financial uncertainty. outside variables. Also, start-ups are vulnerable to outside forces beyond their control due to market volatility & economic downturns. When contemplating investments in start-up companies, investors need to carefully evaluate these risks & challenges & devise plans to minimize potential losses. Investors should perform extensive due diligence and research before committing capital to start-up companies in order to make wise investment decisions.

The business model, competitive landscape, market positioning, and growth potential of the start-up are critical to comprehend. Gaining insight into the founding team’s vision, strategy, and plan of action through interaction can be very beneficial to the start-up’s chances of success. Investing in start-up companies can also be risk-averse through the use of diversification.

Investors can lessen their exposure to any one company or sector by distributing their money among several start-ups or across various industries. Also, investors can find promising start-up opportunities and make wise investment decisions by keeping up to date on market dynamics, industry trends, and emerging technologies. Also, getting help navigating the challenges of investing in start-up companies can be obtained from seasoned mentors, angel investors, or venture capitalists. Creating a network inside the startup ecosystem can also provide access to important industry insights & possible investment opportunities.

Investors can improve their chances of making wise choices & profiting from the potential gains of creative start-ups by heeding these recommendations & taking a calculated approach to investing in start-up businesses. To conclude, investors looking for cutting-edge technologies and high-growth prospects will find that start-up companies offer an exciting new frontier. Despite the risks and difficulties that come with investing in start-ups, there is also a chance to support ground-breaking ideas that have the power to influence entire industries and earn hefty returns. Investing in start-up companies can be a transformative experience for investors if they take a strategic approach to investment decisions, stay up to date on industry trends, and carefully consider investment criteria. An alluring environment for investors hoping to participate in the next wave of disruptive innovation is presented by the start-up ecosystem’s continued evolution and driving of technological advancements.

If you are looking to invest in start-up companies, you should check out Slay Ventures. They are a venture capital firm that is breaking the mold by focusing on women entrepreneurs. According to a recent article on their website, “Venture Capital’s New Vanguard: Women Who Are Breaking the Mold,” they are dedicated to supporting and investing in female-led start-ups. You can learn more about their investment opportunities and apply to become a part of their portfolio by visiting their website.

FAQs

What are start-up companies?

Start-up companies are newly established businesses with a focus on developing and offering innovative products or services. These companies are typically characterized by their high growth potential and are often in the early stages of development.

Why should I consider investing in start-up companies?

Investing in start-up companies can offer the potential for high returns on investment, as these companies have the opportunity to grow rapidly and become successful. Additionally, investing in start-ups allows individuals to support and be a part of the development of new and innovative products and services.

What are the risks associated with investing in start-up companies?

Investing in start-up companies carries a higher level of risk compared to more established businesses. Start-ups often face challenges such as market acceptance, competition, and financial instability. There is also a higher likelihood of failure for start-up companies, which can result in the loss of investment.

How can I find start-up companies to invest in?

There are various ways to find start-up companies to invest in, including networking with entrepreneurs and industry professionals, attending start-up events and pitch competitions, and utilizing online platforms that connect investors with start-up opportunities. It’s important to conduct thorough research and due diligence before investing in any start-up company.

What are some key factors to consider when evaluating a start-up company for investment?

When evaluating a start-up company for investment, it’s important to consider factors such as the strength of the business idea, the experience and expertise of the founding team, the market potential for the product or service, the company’s financial projections, and the overall scalability of the business. Additionally, understanding the competitive landscape and potential risks is crucial in making an informed investment decision.

Leave a Reply

You must belogged in to post a comment.